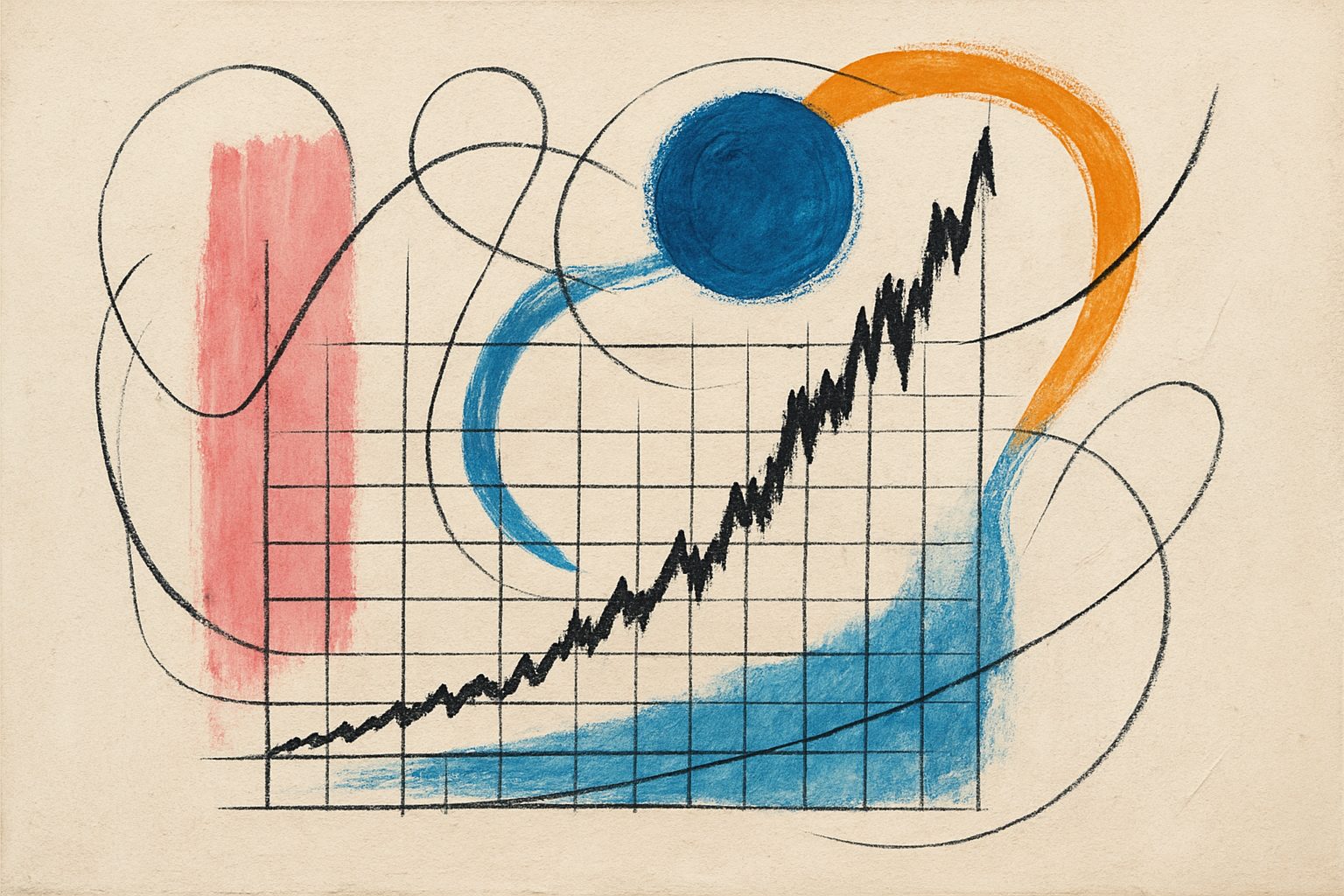

The visualization above presents a detailed analysis of the NASDAQ’s evolution over the past century, emphasizing critical periods of economic turmoil that have significantly influenced market dynamics. Notably, three major crises—the Dot-com Bubble around 2000, the Global Financial Crisis in 2008, and the COVID-19 downturn in 2020—emerged as pivotal events that reshaped investor sentiment and index performance. Data from Macrotrends [R2] illustrates how the dramatic rise and subsequent collapse during the Dot-com era not only transformed investor expectations but also established the foundation for contemporary technology market behaviors. Insights from Nasdaq’s official platform [R3] further elaborate on how the 2008 financial crisis precipitated severe corrections in the index, highlighting the sensitive relationship between global economic stability and market performance. Additionally, comprehensive economic indicators from GuruFocus [R4] emphasize that the pandemic-induced crash in 2020 resulted in unprecedented volatility and rapid recovery patterns. Further analysis from GuruFocus’s updated statistics [R5] and additional economic insights [R6] reveal the recurring impact of external shocks on the NASDAQ’s long-term growth trajectory. These events are corroborated by additional information available on Nasdaq’s analysis portal [R7] and reiterated in discussions of Nasdaq’s historical context [R8], demonstrating that, despite episodes of intense crisis, the market has consistently rebounded, adapting to evolving economic realities. This thorough examination not only delineates these critical junctures but also serves as a foundation for understanding the resilience and dynamic shifts inherent within one of the world’s leading stock market indices.