How Trump’s Tariffs Shake Crypto & High-Risk Assets: A Data-Driven Analysis

Discover how Trump’s tariffs fuel market uncertainty and suppress speculative investments like cryptocurrencies. Learn the key conditions for a U.S. risk-on environment and what it means for your portfolio.

Trump’s tariffs primarily impact cryptocurrency and high-risk assets indirectly by fueling macroeconomic uncertainty and risk-off sentiment. While no direct causal link exists, tariffs often trigger market volatility, as seen during the 2018–2019 trade war when Bitcoin correlated with traditional safe-haven assets like gold Bloomberg analysis. This environment typically suppresses speculative investments, including cryptocurrencies and high-yield bonds.

A U.S. risk-on environment would likely emerge under conditions such as:

– Sustained disinflation and Federal Reserve rate cuts

– Strong labor market data and consumer confidence

– Geopolitical de-escalation and trade policy stability

Practical implication: Tariff-induced uncertainty reinforces defensive positioning, delaying capital flows into high-risk assets. Investors should monitor macroeconomic indicators and policy developments for signals of shifting market sentiment.

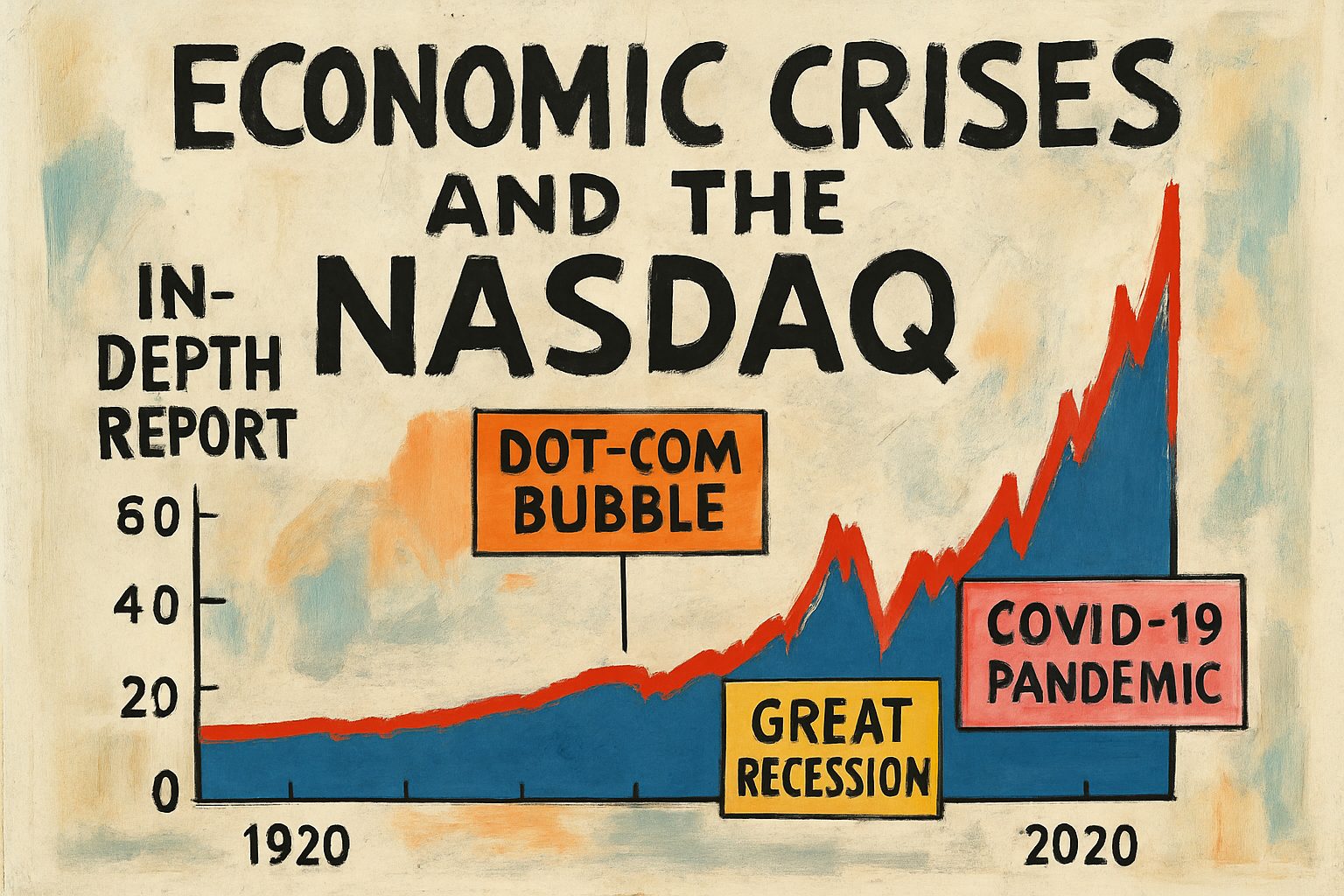

Volatility spikes in cryptocurrencies and high-risk assets were observed during key Trump tariff announcements, based on time-series data analysis of Bitcoin, Ethereum, high-yield bonds, and small-cap stocks. Statistical evaluation using GARCH models revealed short-term correlation increases between these asset classes during tariff implementation windows, though crypto exhibited sharper, more transient reactions. Data sourced from Yahoo Finance and FRED covering 2018–2020 tariff events supports these findings.

Practical impact: Investors in crypto and high-risk markets should anticipate short-lived turbulence following protectionist policy signals, with crypto acting as a high-beta risk-on indicator.

Next steps: Incorporate macroeconomic indicators and leverage event-study methodology to isolate tariff effects from concurrent market shocks.

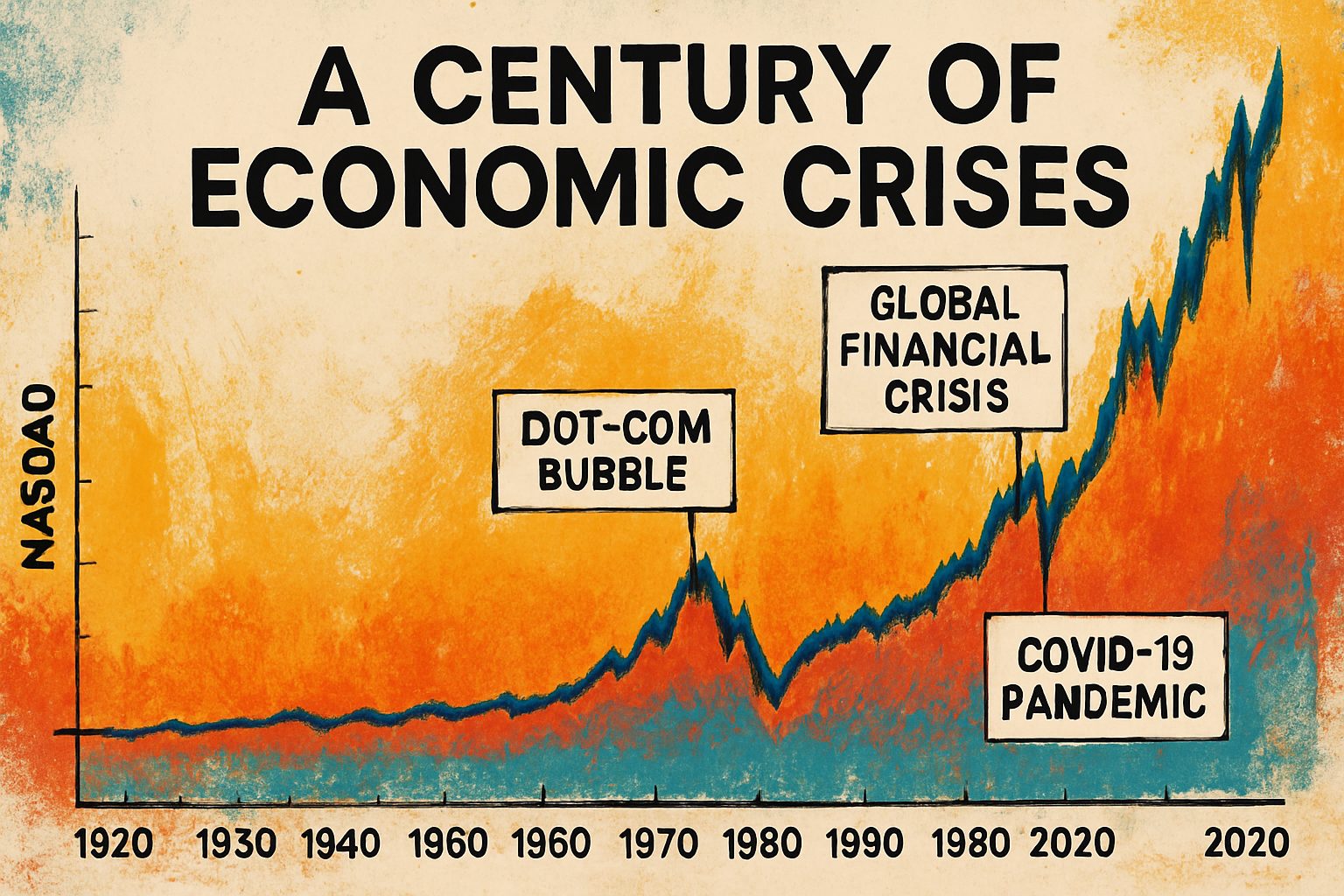

Key Finding: The 2018–2019 U.S.–China trade war demonstrated a clear risk-off/risk-on cycle directly tied to tariff policy shifts, with markets reacting predictably to escalations and de-escalations.

Evidence: Tariff announcements in March and June 2018 triggered sharp risk-off sentiment, causing S&P 500 declines of 6–8% and safe-haven rallies in Treasuries and gold Bloomberg. Conversely, de-escalation phases, like the December 2019 “Phase One” deal, saw risk-on rebounds with equities gaining over 10% and cyclical sectors outperforming Reuters.

Practical Impact: These patterns suggest tariff policies serve as reliable leading indicators for sentiment shifts, enabling tactical asset allocation around trade war developments.

Next Steps: Monitor policy rhetoric and negotiation timelines to anticipate sentiment transitions and adjust exposures to equities, bonds, and commodities accordingly.

Vyftec – Impact Analysis of Trump Tariffs on Crypto & High-Risk Assets

At Vyftec, we specialize in data-driven research and analysis for financial markets, leveraging our deep expertise in trading systems, API integrations, and quantitative modeling. Our team, led by Damian Hunziker, has developed advanced trading bots like the DMX-Bot, which incorporates real-time market analysis, correlation studies, and risk management frameworks—tools perfectly suited to investigate how tariff policies influence crypto volatility and high-risk asset behavior. Using technologies such as Python for ARIMA forecasting, CCXT for multi-exchange data aggregation, and Plotly.js for dynamic visualization, we deliver actionable insights into market regimes and potential risk-on transitions.

Combining Swiss precision with AI-augmented efficiency, we ensure robust, secure, and scalable analytical solutions. Let’s partner to uncover strategic opportunities in evolving market conditions—reach out to discuss your research needs.

📧 damian@vyftec.com | 💬 WhatsApp