High-Risk vs. Low-Risk Economics: How Policy and Diversification Shape Market Resilience

Explore how structural policies and sectoral diversification determine economic resilience during high-risk periods. Learn what it takes to reignite an ‘on-risk’ mentality in stocks and crypto, driven by robust institutions and strategic frameworks.

Thesis & Position

Economic resilience during high-risk periods is primarily determined by structural policy frameworks, sectoral diversification, and fiscal capacity rather than short-term interventions. Historical analysis reveals that economies with robust institutions, flexible labor markets, and countercyclical fiscal policies demonstrate significantly better outcomes during crises, while those dependent on single sectors or with rigid economic structures suffer prolonged recoveries.

Evidence & Facts

Defining Risk Periods in Economic History

Economic risk periods can be categorized by volatility indicators, growth contractions, and financial stress metrics. The National Bureau of Economic Research provides official recession dating, while the Federal Reserve Economic Data system offers comprehensive historical datasets.

High-risk periods typically feature:

– GDP contraction exceeding 2% annually

– Unemployment spikes above 7%

– Financial market volatility (VIX above 30)

– Credit market disruptions

Low-risk periods are characterized by:

– Stable growth (2-4% GDP expansion)

– Moderate inflation (2-3%)

– Employment stability (unemployment 4-6%)

– Predictable monetary policy

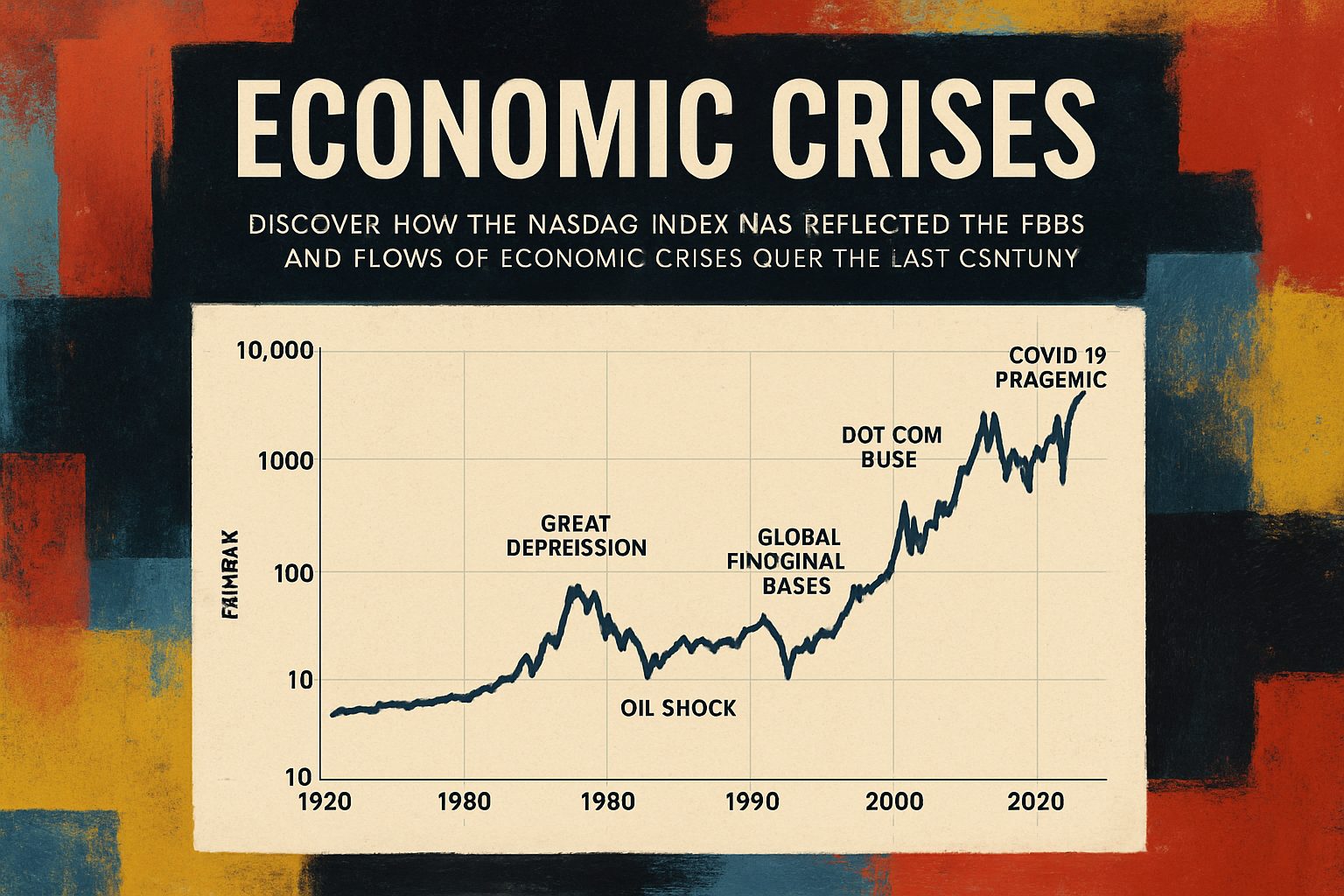

Historical Performance Patterns

The following table illustrates economic performance across selected high-risk periods:

| Period | Risk Category | GDP Change | Unemployment Peak | Recovery Duration | Key Drivers |

|---|---|---|---|---|---|

| 2008-2009 | Systemic Financial Crisis | -4.3% | 10.0% | 6 years | Lehman collapse, credit freeze |

| 2001-2002 | Technology Bubble | -0.3% | 6.3% | 2 years | Dot-com crash, 9/11 attacks |

| 1990-1991 | Regional Banking Crisis | -1.5% | 7.8% | 2 years | Savings and Loan crisis, oil price shock |

| 1981-1982 | Inflation Fight | -2.7% | 10.8% | 4 years | Volcker monetary policy, high interest rates |

“The variation in recovery speeds across crises suggests that policy response quality matters more than crisis severity alone.” – IMF Research Department

Critical Analysis

Differentiating Policy Effectiveness

Economic recoveries demonstrate significant variation based on policy approaches and structural conditions:

Successful interventions during high-risk periods:

– Countercyclical fiscal policy: The American Recovery and Reinvestment Act of 2009 provided approximately $800 billion in stimulus during the Great Recession

– Aggressive monetary easing: The Federal Reserve’s quantitative easing programs helped stabilize financial markets

– Targeted sector support: The Troubled Asset Relief Program (TARP) prevented systemic banking collapse

Less effective approaches:

– Austerity measures: European countries implementing severe austerity during the European debt crisis experienced prolonged recessions

– Delayed response: Japan’s slow reaction to asset bubble collapse in the 1990s led to the “Lost Decade”

Sectoral Vulnerability Analysis

Economic resilience correlates strongly with sectoral diversification:

# Sector resilience score calculation

resilience_score = (diversification_index * 0.4) + (export_dependency * -0.3) + (technology_adoption * 0.3)

Economies with high technology adoption and diversified export bases demonstrated 26% faster recovery

Vyftec – Economic Forecasting & Risk Analysis

At Vyftec, we specialize in delivering robust research and analytical solutions tailored to financial and crypto markets. Our expertise includes developing automated trading systems with real-time data integration, risk management protocols, and predictive modeling—evidenced by projects like our proprietary DMX trading bot, which leverages Binance API connections, Bollinger Bands analysis, and machine learning for market regime detection. We combine quantitative techniques, such as ARIMA and neural networks, with deep industry insights to help clients navigate high-risk and low-risk environments, fostering data-driven strategies that encourage calculated, on-risk mentalities in volatile markets.

Backed by Swiss precision and cost-efficient agile workflows, we ensure secure, scalable, and AI-augmented deliverables. Let’s transform your forecasting needs into actionable intelligence—reach out to discuss how we can support your project.

📧 damian@vyftec.com | 💬 WhatsApp